So the total is the P550 terminal fee. The income tax rates 2021 exemption limit for compensation for loss of employment will be increased from RM10000 to RM20000 for each.

Individual Income Tax In Malaysia For Expatriates

Section 121a serves as a residual section to tax whatever gross income that is not attributable to operations of business carried on outside Malaysia would be deemed Malaysian derived income.

. Directors fees income received as a non-Malaysian citizen director of a Labuan entity are exempted from income tax until YA 2025. The economy of Malaysia is the third largest in Southeast Asia and the 34th largest in the world in terms of GDP. Crude rate of natural increase in Malaysia 2015-2020 by ethnic group.

An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Ascertain tax by applying Indian rate of tax as well as rate of foreign country separately. Working age population Philippines 2006-2017.

5893 which usually amounts to P5893. In addition Malaysia is. Crude death rate in Malaysia 2015-2020 by ethnic group.

Resident companies are taxed at the rate of 24. How to Change Address in Income Tax Site. Annual gross income.

This page provides the latest reported value for - Malaysia Consumer Price. Grant or subsidy received from the Federal or State Government are exempted from income tax. Mean monthly income per household Malaysia 2019 by ethnic group.

20 Non-Malaysian directors fees income from a Labuan entity. There should be another item called the PH PSC Value Added Tax. Consumer Price Index CPI in Malaysia averaged 7426 points from 1972 until 2022 reaching an all time high of 12740 points in June of 2022 and a record low of 2430 points in January of 1972.

1 Visit Income Tax Site 2 Go to profile Setting 3 Select My Profile 4 Select Address 5 Click on Edit and make necessary changes and click save. According to the Global Competitiveness Report 2021 the Malaysian economy is the 25th most competitive country economy in the world. We are customizing your profile.

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals corporations trusts and othersTax evasion often entails the deliberate misrepresentation of the taxpayers affairs to the tax authorities to reduce the taxpayers tax liability and it includes dishonest tax reporting declaring less income profits or gains than the amounts actually earned overstating. Whichever is less relief is given to that extent. There are no other local state or.

After the Asian financial crisis of 1997-1998 Malaysias economy has been on an upward trajectory averaging growth of 54 since 2010 and is expected to achieve its transition from an upper middle-income economy to a high-income economy by 2024. All calculation in Rupees Salary from India Salary from Australia Total Income- 690000 Tax on above in India-70000 Ascertain doubly taxed income ie 240000. The main objective is to help taxpayers who have lost their jobs due to the current pandemic.

States with the lowest mean annual salary for architects 2017. This I believe is the PH airport terminal fee. For example an employee who works 8 hours a day for a monthly salary of RM130000 would have an ordinary rate of pay of RM50 RM1300 26 RM50.

Monthly income in Malaysian ringgit-----. This terminal fee should be refundable for OFWs with OEC. That employees hourly rate of pay would be RM625 RM50 8 hours RM625.

Air Passenger Departure Tax PHP 77059 is this the travel tax. The rate of WHT on such income is 10. Budget 2021 is the largest budget in Malaysias history with a total of RM3225 billion compared to RM297 billion for Budget 2020.

The 2018 labour productivity of Malaysia was measured at Int55360 per worker the third highest in ASEAN. Ascertain doubly taxed income. Consumer Price Index CPI in Malaysia increased to 12740 points in June from 12660 points in May of 2022.

This is applicable on payments made to residents of all the treaty partners listed except for certain countries including Germany Turkmenistan Bosnia and Herzegovina Senegal and Jordan where the respective tax treaties have provided for such type of income to be taxed only in the contracting state. The scope is wider than merely to treat gross income that is attributable to business operations carried on in Malaysia. No other taxes are imposed on income from petroleum operations.

Hourly rate of pay means the ordinary rate of pay divided by the normal hours of work. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

21 Government grant or subsidy.

How Do Taxes Affect Income Inequality Tax Policy Center

Corporate Income Tax And Effective Tax Rate Download Table

Progressive Tax Definition Taxedu Tax Foundation

Income Tax Formula Excel University

Income Tax Formula Excel University

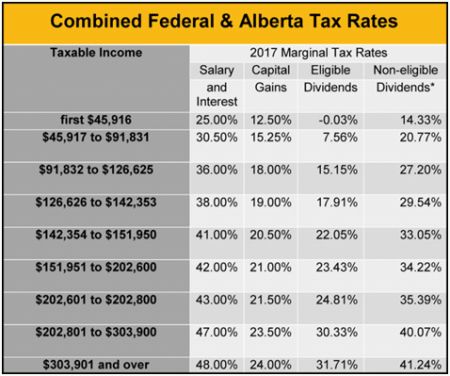

Alberta 2017 Budget Corporate Tax Canada

How Do Taxes Affect Income Inequality Tax Policy Center

Doing Business In The United States Federal Tax Issues Pwc

How To Calculate Foreigner S Income Tax In China China Admissions

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Income Slab Tax Rates For Ay 2018 19 Fy 2017 18 Income Tax Return Income Tax Tax Exemption

How Do Taxes Affect Income Inequality Tax Policy Center

Income Tax Formula Excel University

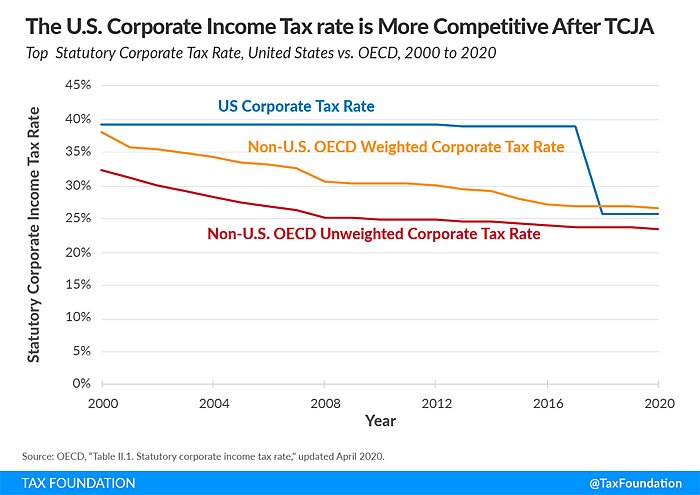

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

Scott S Skin In The Game Plan Could Raise Taxes By 100 Billion In 2022 Mostly On Low And Moderate Income Households

Asiapedia Iras 2017 Singapore Personal Income Tax Dezan Shira Associates

How To Calculate Tax On Salary Store 58 Off Www Ingeniovirtual Com

How Do Taxes Affect Income Inequality Tax Policy Center

Income Tax Formula Excel University